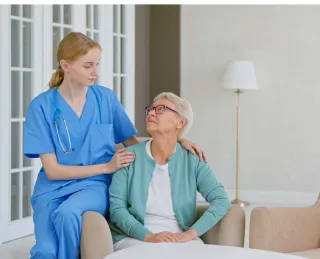

Long-term care protection

Caring expertise, every step of the way.

Quote, Compare, and Submit

What is long-term care?

Long-term care (LTC) protection involves a variety of services designed to meet a person’s health or personal care needs when they can no longer perform those activities on their own.

Long-term care and protection

At home

Receive informal or home health care from professionals and/or family members and friends as available by product.

Community support

Receive care through adult day care services from health care professionals.

Facilities

Receive care in facilities offering assisted-living or full-time care, as needed.

Our long-term care protection options include:

Asset Care®

Whole Life insurance with long-term care Benefits

Combining whole life insurance with long-term care benefits, Asset Care allows you to receive and pay for care or other qualified long-term care services according to your needs and preferences, in your home or in a facility. If you do not require long-term care support, the cash value of your policy remains accessible for emergencies or can be passed on as a death benefit, securing your financial legacy.

Annuity Care®

Annuities with long-term care benefits

Our annuity-based solutions can allow you to leverage the value of your annuity to pay for qualified long-term care needs. Protection can last from a few years to your lifetime, through an optional coverage extension. When you use your annuity’s value for qualifying long-term care expenses, the benefits are tax-free, offering security and financial savings. Our Annuity Care product portfolio includes three products: Annuity Care, Annuity Care II, and Indexed Annuity Care.

Understanding long-term care basics

Navigating the complexities of long-term care can be daunting, but it doesn’t have to be. Our comprehensive planning guide offers tools and insight to help you prepare for and make informed decisions for the journey ahead.

Already have long-term care protection?

Before starting any long-term care services, contact Americas insurance Merchantry to confirm that your chosen services and providers align with your policy benefits. This proactive step can streamline your claims process and help ensure you receive the care benefits you’re entitled to.

Frequently Asked Question

What exactly does long-term care cover?

long-term care typically covers a range of services designed to help with daily living activities. That can include help with bathing, dressing, eating, and sometimes even medical care that’s not covered by regular health insurance.

When should I start planning for long-term care?

It’s generally wise to start thinking about it in your 50s or early 60s, while you’re still in good health. That way you have more options and potentially lower costs.

How do I pay for long-term care?

There are several ways, including long-term care insurance policies, personal savings, or sometimes government programs like Medicaid if you qualify. It’s really about figuring out the best approach for your situation.

Are you ready to insure yourself or a loved one?

Want to learn more about long-term care protection

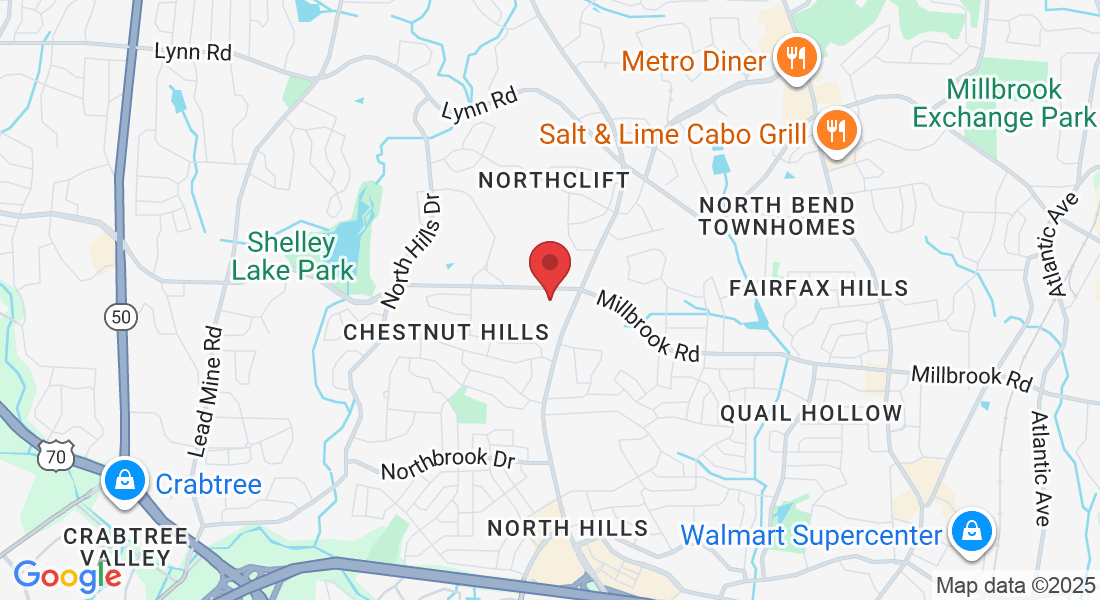

The companies of Ai Merchantry™ have appointed general agencies across the country to give you local, personalized support. Click on the icon closest to you to learn more and start the conversation. If you don’t see your state or region represented.

Call us at 1-844-448-2246 or email us at [email protected]

Contact us

Assistance Hours

Mon – Fri

9:00am – 6:00pm

Email: [email protected]

Phone

1-844-448-2246

Address

207 W. Millbrook Road Suite 210

Raleigh, NC 27609

Content not currently applicable for residents of CA, CT, DC, FL, KS, MA, NH, PA, VT, and WI.

OneAmerica Financial is the marketing name for the companies of OneAmerica Financial. Products issued and underwritten by The State Life Insurance Company® (State Life), Indianapolis, IN, a OneAmerica Financial company that offers the Care Solutions product suite. Asset Care Form numbers: ICC18 L302, ICC18 L302SP, ICC18 L302 JT, ICC18 L302 SP JT, ICC18 SA39, ICC18 R540, ICC24 R545, and ICC24 R546. Annuity Care Form numbers:SA34, R508, SA34 (NC)-R, SA34 (NC) TQ-R. Annuity Care II Form numbers: ICC15 SA35, ICC15 R521 PPA ND, ICC15 R521 PPA, ICC R522 PPA, SA35, SA35 (NC). Indexed Annuity Care Form numbers: ICC14 SA36, ICC14 R529, ICC14 R529 PPA, ICC14 R530, ICC14 R530 PPA, SA36, R529, R529 PPA, R530, and R530 PPA. Not available in all states or may vary by state. • Provided content is for overview and informational purposes only and is not intended as tax, legal, fiduciary, or investment advice. Care Benefit Concierge services is a company practice and not a long term care benefit and may be subject to change. • The policies and long-term care insurance riders have exclusions and limitations. Details about the cost, benefits, limitations and exclusions of this policy and long-term care riders will be provided by a licensed insurance agent. • This is a solicitation of insurance. An insurance agent or insurance company will contact you.

Copyright © 2025 Americas insurance Merchantry ™ - 32AiM, Llc. Company. All Rights Reserved.