Annuity Care

Annuities with long-term care benefits.

Quote, Compare, and Submit

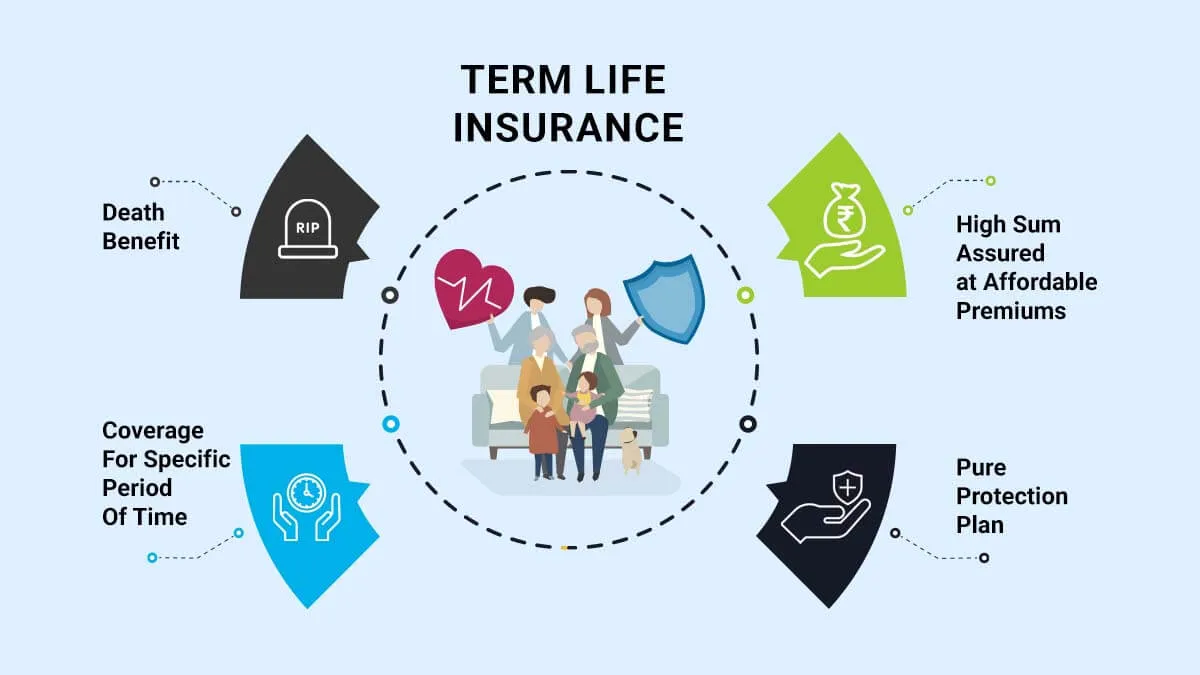

What are Annuities with LTC Benefits?

Our Annuity Care portfolio uses annuities — your asset — to help pay for long-term care expenses if they’re needed. Your single premium payment pays for a deferred or indexed annuity to help protect your retirement income stream if the need for care arises.

The annuities can provide tax-free payments for qualified long-term care options align with your policy and plan of care. Get started with care provided by professionals in your home, transitioning as needed to more advanced or in-facility options.

Home Health Care

Medical and non-medical

services, including those offered by independent2 providers, can allow you or a loved one to continue living safely and comfortably at home. While assisting with the activities of daily living, service providers may also help with tasks like cooking, cleaning and laundry.

Adult day care

Day programs provide care, companionship and activities for older adults and give caregivers freedom to go to work, handle personal business or relax.

Assisted living

Residents usually live in their own apartments or rooms and share common areas. They have access to services, meals, laundry, social and recreational activities, assistance with personal care, and 24-hour supervision.

Nursing home

Skilled nursing facilities provide services with a greater focus on medical care than most assisted living facilities. Services typically include nursing care, 24-hour supervision, three meals a day and assistance with everyday activities.

Annuity Care helps protect your retirement income against the impact of long-term care-related expenses. You can even pass unused funds to your beneficiaries — tax-free. Most important of all, having this protection in place helps provide you and your family peace of mind that if and when you do need care, we provide our compassionate, experienced support.

Tailoring a policy for you and your family

With our Annuity Care portfolio, you’re free to choose from a variety of ways to pay for and customize your policy.

Different ways to fund your annuity

Work with your financial professional to identify optional ways to fund your annuity which can include using cash premiums, in either a single or recurring payment, qualified3 or non-qualified dollars.

Options to customize your policy

Consider a variety of options to help customize your long-term care benefits to meet your specific needs, including:

* Single or joint protection

* Inflation protection

* Length of benefit, up to your lifetime benefits

Are you ready to insure yourself or a loved one?

You have a team beside you

Annuity Care can help ease the physical, financial, and emotional burdens of long-term health care and aging while helping to minimize stress on your loved ones. It can provide you and your family with an option to access a support network that shares ongoing guidance, helps keep informal caregivers healthy and helps protects family relationships. From day one of your claim, your Care Benefit Concierge will assist to alleviate burdens and be your go-to resource for your long-term care benefits and beyond.

Already have long-term care protection?

Before starting any long-term care services, contact Americas insurance Merchantry to confirm that your chosen services and providers align with your policy benefits. This proactive step can streamline your claims process and help ensure you receive the care benefits you’re entitled to.

Want to learn more about long-term care protection

The companies of Ai Merchantry™ have appointed general agencies across the country to give you local, personalized support. Click on the icon closest to you to learn more and start the conversation. If you don’t see your state or region represented.

Call us at 1-844-448-2246 or email us at [email protected]

Contact us

Assistance Hours

Mon – Sat

9:00am – 6:00pm

Email: [email protected]

Phone

1-844-448-2246

Address

207 W. Millbrook Road Suite 210

Raleigh, NC 27609

Content not currently applicable for residents of CA, CT, DC, FL, KS, MA, NH, PA, VT, and WI.

1. In California, independent providers are under the personal care services provision.

2. In California, assisted living facilities are also known as residential care facilities.

3. In California, use of qualified dollars is not available.

4. Premium payment method can differ between the base annuity and continuation of benefits for long-term care insurance rider option.

5. Continuation of benefits for long-term care insurance rider is available for an additional cost.

OneAmerica Financial is the marketing name for the companies of OneAmerica Financial. Products issued and underwritten by The State Life Insurance Company® (State Life), Indianapolis, IN, a OneAmerica Financial company that offers the Care Solutions product suite. Not available in all states or may vary by state. • Provided content is for overview and informational purposes only and is not intended as tax, legal, fiduciary, or investment advice. Annuity Care Form numbers: SA34, R508, SA34 (NC)-R, SA34 (NC) TQ-R. Annuity Care II Form numbers: ICC15 SA35, ICC15 R521 PPA ND, ICC15 R521 PPA, ICC15 R522 PPA, SA35 SA35 (NC). Indexed Annuity Care Form Numbers: ICC14 SA36, ICC14 R520 PPA, ICC14 R520, ICC14 R530 PPA, ICC14 RS30, SA36, R529 PPA, R529, R530 PPA, R530.

Policies, contracts and long-term care insurance riders are underwritten by The State Life Insurance Company®, Indianapolis, Indiana. This is a solicitation of long-term care insurance. Details about the cost, benefits, limitations and exclusions of these policies and long-term care insurance riders will be provided to you by a licensed insurance agent/producer. When you respond, an insurance agent/producer will contact you. These products require medical underwriting.

To be eligible for benefits the insured must be a chronically ill individual, with qualified long-term care services provided pursuant to a plan of care prescribed by a licensed health care practitioner. Care Benefit Concierge services is a company practice and not a long term care benefit and may be subject to change.

Copyright © 2025 Americas insurance Merchantry ™ - 32AiM, Llc. Company. All Rights Reserved.