Asset Care

Whole life insurance with long-term care benefits.

Quote, Compare, and Submit

What is Asset Care?

Asset Care is a whole life insurance policy — your asset — designed to help pay for long-term care expenses if they’re needed. Your premium payment provides a guaranteed death benefit that can be accessed, tax-free, to help pay for qualifying long-term care services.

With Asset Care, you’re free to choose from a range of flexible caregiving options that align with your policy and plan of care. Get started with care provided by a family member or friend at home — and keep your options open. Transition to professional support through independent providers or home health care agencies, or more managed options as needed.

Informal Care

Some early long-term care needs do not require specialized knowledge or physical intervention, and those needs can be met by family and friends1 in your home.

Home health care

Medical and nonmedical services, including those offered by independent2 providers, can allow you or a loved one to continue living safely and comfortably at home. While assisting with the activities of daily living, service providers may also help with tasks like cooking, cleaning and laundry.

Adult day care

Day programs provide care, companionship and activities for older adults and give caregivers freedom to go to work, handle personal business or relax.

Assisted Living

Residents usually live in their own apartments or rooms and share common areas. They have access to services, meals, laundry, social and recreational activities, assistance with personal care, and 24-hour supervision.

Nursing Home

Skilled nursing facilities provide services with a greater focus on medical care than most assisted living facilities. Services typically include nursing care, 24-hour supervision, three meals a day and assistance with everyday activities

Guaranteed protection

Asset Care provides for all the guarantees associated with whole life insurance, but with the potential for use when long-term care needs arise.

Once the policy is issued, we cannot increase premiums for that coverage.

Long-term care benefits never decreased

Cash value growth

Death benefit if not used for long-term care expenses

Option to have your premium returned5

Tailoring a policy for you and your family

With Asset Care, you’re free to choose from a variety of ways to pay for and customize your policy.

Different ways to fund your policy

Adding Asset Care to your financial protection strategy doesn’t have to add to your expenses. Work with your financial professional to identify optional ways to fund your Asset Care policy which can include using cash premiums, such as savings or current income, in either a single or recurring payment, qualified or non-qualified dollars.

Options to customize your policy

In addition to guarantees outlined above, Asset Care offers a variety of options to help customize your long-term care benefits to meet your specific needs, including:

* Single or joint protection

* Inflation protection

* Length of benefit, up to your lifetime benefits

Are you ready to insure yourself or a loved one?

You have a team beside you

Asset Care can help ease the physical, financial, and emotional burdens of long-term health care and aging while helping to minimize stress on your loved ones. It can provide you and your family with an option to access a support network that shares ongoing guidance, helps keep informal caregivers healthy and helps protects family relationships. From day one of your claim, your Care Benefit Concierge will assist to alleviate burdens and be your go-to resource for your long-term care benefits and beyond.

Already have long-term care protection?

Before starting any long-term care services, contact Americas insurance Merchantry to confirm that your chosen services and providers align with your policy benefits. This proactive step can streamline your claims process and help ensure you receive the care benefits you’re entitled to.

Want to learn more about long-term care protection

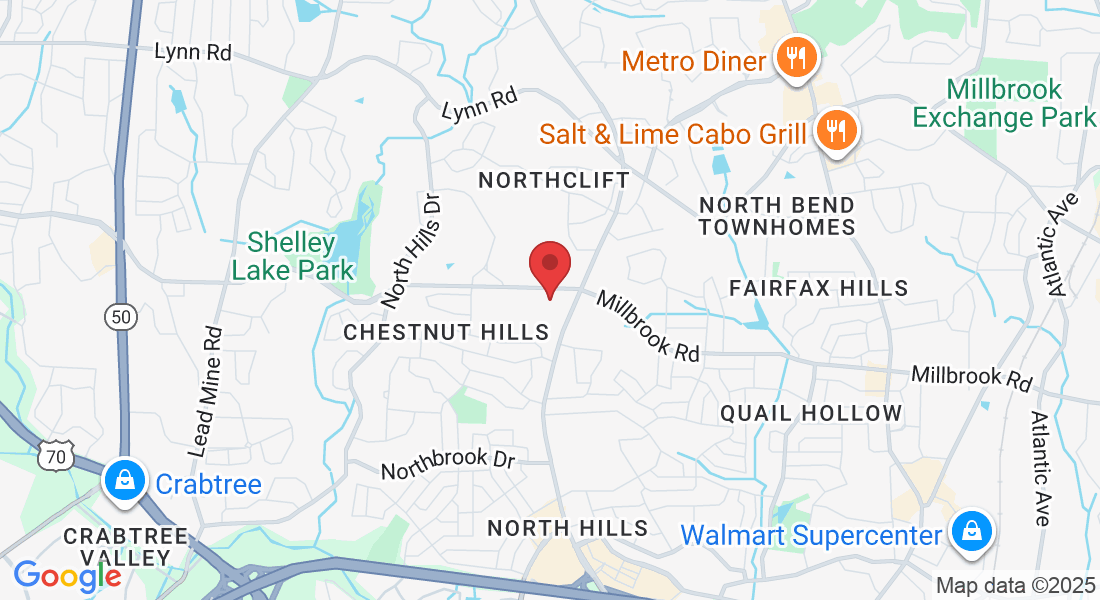

The companies of Ai Merchantry™ have appointed general agencies across the country to give you local, personalized support. Click on the icon closest to you to learn more and start the conversation. If you don’t see your state or region represented.

Call us at 1-844-448-2246 or email us at [email protected]

Contact us

Assistance Hours

Mon – Sat

9:00am – 6:00pm

Email: [email protected]

Phone

1-844-448-2246

Address

207 W. Millbrook Road Suite 200

Raleigh, NC 27609

Copyright © 2025 Americas insurance Merchantry ™ - 32AiM, Llc. Company. All Rights Reserved.